We’re excited to share our expertise on AI SaaS for Digital Nomads. These tools are changing how we manage finances while traveling. As digital nomads, managing money can be tough. But AI-powered SaaS tools make it easier to do financial tasks from anywhere.

AI SaaS for Digital Nomads offers personalized financial insights and automates tasks. It also boosts security. We’re looking at the best AI SaaS tools for digital nomads. They help manage finances smoothly while traveling, using AI for finance.

Tools like those reviewed on AI generator reviews are making a big difference. We’re excited to explore how these tools are changing the game for digital nomads. We’ll focus on AI SaaS for Digital Nomads.

Introduction to AI-Powered Financial Management

We think AI SaaS for Digital Nomads can make financial management tools more accessible. We’re committed to sharing our knowledge. This will help digital nomads make smart financial decisions with the latest AI for finance solutions.

Key Takeaways

- AI SaaS for Digital Nomads is revolutionizing financial management on the go

- AI-powered SaaS tools provide personalized financial insights and automate tasks

- AI for finance solutions enhance security and streamline financial management

- Digital nomads can benefit from AI SaaS tools to handle financial tasks remotely

- AI SaaS for Digital Nomads is democratizing access to financial management tools

The Rising Need for AI-Powered Financial Tools in Digital Nomad Life

Digital nomadism is changing how we work and manage money. With more people working remotely, managing finances gets harder. AI tools offer real-time insights, automate tasks, and boost security. They’re key for digital nomad finance needs.

AI tools help digital nomads in many ways. They track expenses, convert currencies, plan budgets, and protect against fraud. These tools make managing money easier and less stressful.

By using remote finance tools, digital nomads can manage their money better. They can handle different bank accounts, track expenses, and keep up with taxes. AI tools are changing how digital nomads handle their finances.

We’re excited to explore AI tools for digital nomads. They offer insights, automate tasks, and improve security. These tools are changing how digital nomads manage their money. As we learn more, we’ll see the latest trends and tools for remote finance.

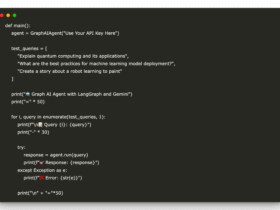

Understanding AI SaaS for Digital Nomads: A Comprehensive Overview

Effective financial management is key for digital nomads. That’s why AI SaaS for Digital Nomads is so important. These tools use artificial intelligence to understand financial data, offer tailored advice, and handle tasks automatically. This makes it simpler for digital nomads to manage their money while traveling.

SaaS for budgeting helps digital nomads keep track of their spending, set budgets, and make smart money choices. With AI tools, they can manage their finances better, feel less stressed, and enjoy their work or travel more.

AI SaaS for digital nomads offers cool features like automatic expense tracking, instant financial updates, and advice on budgeting. These features help digital nomads use their money wisely, reach their goals, and have a more stable financial life.

Using AI SaaS for digital nomads gives people more control over their finances, less uncertainty, and better overall well-being. As more digital nomads join the community, the need for AI financial tools will grow. This will lead to more innovation and better services in the future.

Top AI-Powered Expense Tracking Solutions for Remote Workers

Exploring AI for finance, we find top solutions for remote workers. These tools automate tasks like receipt processing and expense categorization. They help remote workers track expenses easily and make smart financial choices.

These solutions offer automated receipt processing. This lets remote workers upload and categorize receipts quickly. They also support multi-currency, making it simpler to handle international transactions. With AI-powered finance tools, remote workers get real-time expense analytics. This gives them insights into their spending.

AI makes expense tracking easier for remote workers. These solutions save time on manual tracking. Remote workers can then focus on important tasks. With these tools, they manage their expenses well and make informed financial decisions.

Revolutionary AI Tax Management Platforms for Global Citizens

Tax management for digital nomads is complex, with many laws to follow. AI tax management platforms make it easier. They offer automated filing, real-time analytics, and personalized advice. These are key for AI SaaS for Digital Nomads.

AI tax platforms have many benefits:

- Automated tax filing cuts down on mistakes

- Real-time analytics give insights into taxes

- Personalized advice fits each person’s situation

These tools are vital for digital nomad finance. They help manage taxes well and follow global rules. By using AI SaaS, individuals can meet international tax standards easily.

AI tax platforms are changing how digital nomads handle money. They offer advanced features and advice tailored to each person. These platforms are a must for anyone wanting to make tax management simpler and follow global rules.

Smart Budgeting Applications with Machine Learning Capabilities

We know how key budgeting is for digital nomads. That’s why we’re thrilled about SaaS for budgeting changing how remote workers handle money. These smart apps use AI to give users financial insights, helping them make smart money choices.

These apps analyze how you spend money and offer predictive budget analysis. This lets users plan for future costs. Plus, customizable spending categories help understand where money goes. This makes it simpler to spot ways to save.

Some top features of these apps include:

- Predictive budget analysis to forecast future expenses

- Customizable spending categories for a detailed breakdown of spending habits

- International payment integration to facilitate seamless transactions across borders

Machine learning powers these apps, helping digital nomads manage their finances better. With SaaS for budgeting and AI for finance, the future of money management looks very promising!

Investment Management Tools with AI-Driven Insights

We know how vital investment management is for digital nomads. That’s why AI SaaS for Digital Nomads is key in remote finance tools. These tools offer AI insights, helping digital nomads make smart investment choices. They have features like automated advice and real-time tracking, helping remote workers manage their investments better.

These tools offer many benefits, like personalized investment advice, portfolio optimization, and risk management. AI insights help digital nomads feel confident in their investment decisions. Remote finance tools make managing investments easier for more people.

Exploring AI SaaS for Digital Nomads shows how these tools are changing finance management for remote workers. They provide insights and automate investment tasks, giving digital nomads control over their finances. With the right tools, anyone can be a smart investor, no matter where they are or how much experience they have.

Cross-Border Payment Solutions Enhanced by Artificial Intelligence

As digital nomads, we often face complex financial challenges, like cross-border payments. AI for finance makes these transactions simpler and cheaper. It’s making our financial lives easier and more efficient.

AI is changing how we handle our money while traveling. It offers smart currency exchange features and international transfer optimization. These tools help remote workers send and receive money easily across borders.

Smart Currency Exchange Features

AI helps us exchange currencies at the best rates. This is vital for digital nomads dealing with different currencies. AI ensures we get great rates and avoid hidden fees.

International Transfer Optimization

AI also optimizes international transfers. This means we can send and receive money fast and safely. No more worrying about high fees or paperwork. AI makes managing our finances abroad easier and more convenient.

AI-enhanced payment solutions let digital nomads focus on their work and lifestyle. AI for finance helps us deal with international finance smoothly and confidently.

Security Features and Privacy Considerations in AI Financial Tools

Exploring AI SaaS for Digital Nomads, we must focus on security and privacy. These tools handle our sensitive financial info. We look for strong security, like encryption and two-factor authentication, to keep our data safe.

Some important security features to think about include:

- Data encryption to protect financial information

- Two-factor authentication to prevent unauthorized access

- Regular security updates and patches to stay ahead of possible threats

We also check if the AI SaaS follows global rules, like GDPR and CCPA. This way, we can trust AI tools to manage our money safely, no matter where we are.

Integration Capabilities with Existing Digital Nomad Tools

We know how important it is to work well with other digital nomad tools. This includes project management software and time tracking apps. By doing this, AI for finance solutions can help remote workers manage their money better. They can use AI to do tasks automatically and get important insights.

It’s also key to link AI financial tools with accounting platforms. This makes real-time data synchronization possible and cuts down on mistakes. Digital nomads can then focus on important tasks like growing their business and planning, while remote finance tools take care of the money side.

Some main advantages of combining AI financial tools with other digital nomad tools are:

- More automation and efficiency

- Better data accuracy and syncing

- More productivity and less work

By using AI financial tools with other digital nomad tools, remote workers can achieve more. They can grow their businesses faster and be more successful.

Conclusion: Embracing the Future of Remote Financial Management

AI-powered financial tools are changing how digital nomads handle money. They make tracking expenses, budgeting, investing, and making payments easier. These tools help remote workers manage their finances better, feel less stressed, and work more efficiently.

The tools we talked about are designed for digital nomads. They help users control their money and make smart choices anywhere. AI does the hard work, giving insights in real-time and making international money moves simple. Plus, they keep your data safe and follow the rules.

Digital nomads are changing how we work and live. Using these AI tools is key to their success. They save time, reduce money worries, and let remote workers focus on their dreams and adventures. The future of managing money for digital nomads is here, and it’s time to start using it.